What if fleet managers could predict accidents before they happen? While technology hasn't advanced to the development of a crystal ball, vehicle telematics may be the next best thing to help predict and prevent accidents from happening.

What is Vehicle Telematics?

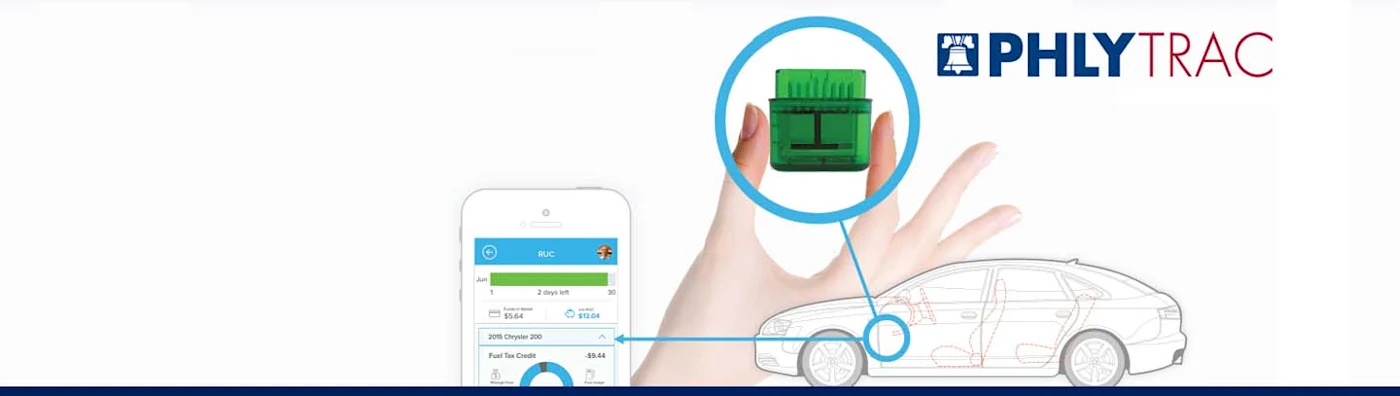

Vehicle telematics is a method of collecting information from a vehicle. Using a GPS receiver that installs into a vehicle's Onboard Diagnostics (OBD-II) port, data is collected and can be viewed on a smartphone app or online account by the policyholder. The information gathered, such as hard braking, speeding, sudden acceleration, and even time of day, can be used to determine driving behavior.

From Personal Auto to Fleet Telematics

Personal auto insurance companies were the first to use vehicle telematics, with a goal of using a driver's real-time data to help calculate premium. This new dynamically priced insurance policy became known as Usage-Based Insurance (UBI). This new model, along with data privacy concerns, gave many pause. But, as Insurance Journal has reported, more people are becoming comfortable with the idea of Usage-Based Insurance policies and all 10 of the top private passenger auto insurers now offer some sort of telematics integrated UBI program.

Commercial auto insurers aren't staying on the sidelines when it comes to vehicle telematics. Philadelphia Insurance Companies' PHLYTRAC was one of the first non-UBI telematics programs of its kind in the commercial auto industry. In 2016, PHLY started a pilot of 5,000 GPS devices distributed to insured fleets that grew to 20,000 devices over the next two years. At the end of the pilot, fleets participating saw hard breaking incidents reduced by 98%, hard acceleration by 97%, speeding events by 69%, and speeding over 15 mph events reduced by 89%. PHLYTRAC was officially launched in 2018 and to date, 15% of PHLY's insured vehicles are protected with PHLYTRAC, logging over 300 million miles. Fleets with PHLYTRAC have seen a 19% reduction in loss frequency compared to fleets without PHLYTRAC.

How the PHLYTRAC Telematics Program Works

PHLYTRAC uses a compact GPS device that installs into a vehicle's OBD-II port. However, unlike telematics programs associated with UBI policies, PHLYTRAC is provided as a risk management and fleet management tool. The data is used by the policyholder to better understand driver behavior and overall fleet exposure. When the insured leverages these insights to make informed decisions that can mitigate their drivers' poor behavior, or promote good behavior, losses are reduced. While the data is not used to make premium calculations (discounts or increases), having a powerful, proactive tool like PHLYTRAC is seen as a positive trait in an organization's overall risk profile, which is taken into consideration when Underwriting prices a policy.

Cost is a major roadblock for many organizations adopting telematics. To remove that roadblock, PHLY covers the cost of PHLYTRAC for Commercial Auto customers, regardless of the account's premium amount or fleet size. PHLYTRAC gives insureds access to powerful tools, including:

An online dashboard: allowing complete control and visualization of telematics data

Live maps: providing real-time vehicle location, giving fleet managers the ability to see the status of all their vehicles at a glance

Customizable alerts: speeding, hard braking, sudden acceleration, excessive idle time, and more

Vehicle health data including odometer tracking

Geofencing: alerting if a vehicle moves outside of a preprogrammed area

Time alerts: alerting if a vehicle is operated outside of a set timeframe

Driver scorecards

Quick and easy hardware installation

Watch the video below for a look into what PHLYTRAC can do for an organization, and how it can promote a strong safety culture by providing actionable insights into driver behavior.

Signing up for PHLYTRAC is also simple. There is no contract. A usage agreement is signed, outlining the program details, and the program can be cancelled at any time. Once the needed information is received, the devices are shipped. The insured is then supported by PHLY and our telematics partner, from installation of the devices to providing guidance on how to introduce the program to employees. Follow the link below to get started with PHLYTRAC!