Whether it's a knock at the door or a call from a child in another room, the distractions that can arise while cooking are endless. However, leaving a hot stovetop unattended, for any reason or any amount of time, can be a deadly and costly mistake. According to the National Fire Protection Association (NFPA), cooking is the leading cause of residential fires and unattended equipment is, by far, the leading factor contributing to cooking fires.

It may only take a few minutes for a cooking fire to engulf an entire home. If no one is in the kitchen when the fire starts, by the time a fire extinguisher is located it may be too late. In many cases, fire extinguishers may not effectively put out a fire due to malfunction, expiration, or human error.

Since the vast majority of cooking fires start when no one is around, the best solutions for extinguishing stovetop fires do not require a person to activate them. These solutions, called reactive devices, are able to suppress or extinguish a fire once it has started, aiming to stop it from spreading and reduce the potential damage. Philadelphia Insurance Companies has partnered with Auto-Out to give policyholders access to a reactive device for their habitational properties at a discounted price. More than 67,000 devices are already in use.

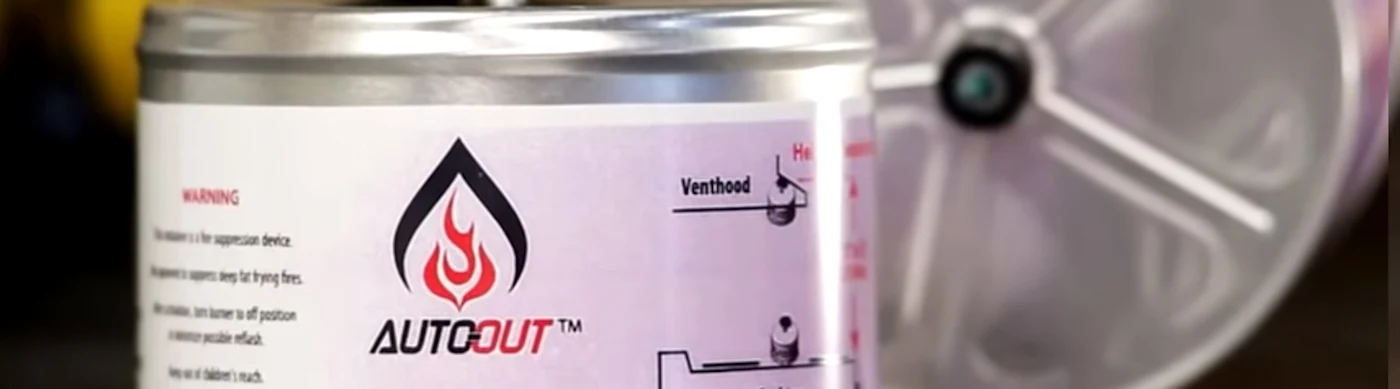

Auto-Out is a fire-suppressant device that easily attaches to cooktops with over-the-range microwaves or standard venthoods. This device is an affordable way to protect property and residents 24 hours a day, seven days a week. Auto-Out is activated by the flames of the fire, so neither smoke, steam, nor heat will activate the device. Watch the video to see how the device works.

With Auto-Out, property owners can have peace of mind knowing their residents are protected and their rental units remain intact. The cost of rebuilding and lost rent from a fire can be detrimental to a property owner's bottom line. Auto-Out helps reduce or eliminate property loss, keep rental units occupied, and prevent large insurance claims.

PHLY policyholders interested in purchasing Auto-Auto devices can visit www.auto-out.com/phly to learn more and place an order.